Assisting Indian Farmers: A Product Discovery Initiative for Better Expense Management

A product discovery project for an expense management tool for Indian farmers focused on understanding their financial challenges. Through interviews and surveys, the initiative essential needs and preferences. By engaging with farmers, the project aimed to create features that enhanced expense tracking and budgeting, ensuring the product effectively supported their financial management.

Research Intent

Validate the problem statement and its gravity in the farmers’ lives. Understand user behaviours and mental models in terms of accounting, cash flow managements, farming practices. Uncover user journeys in farming practices and thus the underlying pain points and their priorities

Why a product discovery was needed?

Farmers in India see farming as a life style and not a profession. They manage their farm and domestic expenses manually today, keep mental notes and maintain paper bills.

How successful would be a mobile application to help them track their expenses? Who could be our target users who would be the early adopters? Is this an opportunity for business or are we really solving a pressing problem for these users

Insights on Users

I met 15 users in Maharashtra, Punjab and Haryana with different farm sizes and 1 or more than agro-based income ( eg. Farming+ harvester/transport/dairy farms/ rice mills/ etc)

Based on field studies, I identified a behavioral pattern of their belief systems and their farming methods, accounting methods and preferences . I outlined archetypes based on these commonalities and traits. I then mapped a journey and traced challenges.

Key Archetypes

The Complacent

-

Relies on farmer stories and forums for information.

-

Rely on an organic way of cash flow and expense management

-

Do not want to change or experiment

The Progressive

-

Strategic rotation of crops.

-

.Adapt newer technology.

-

These are the innovators.

-

They calculate, they evaluate, they reiterate

The Calculative

-

Own Rice Mills

-

Own Dairy Farms

-

Provides unsecured loans ( not approved by RBI )

-

Do not maintain transparency in the loan accounts of the farmers causing exploitation.

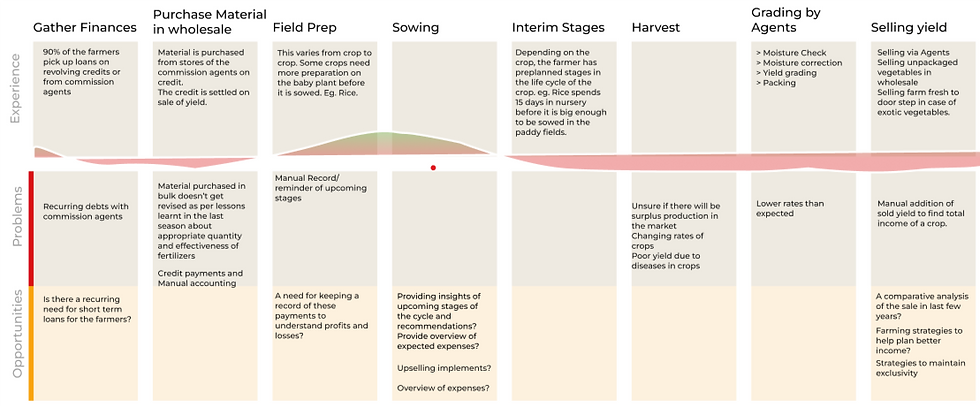

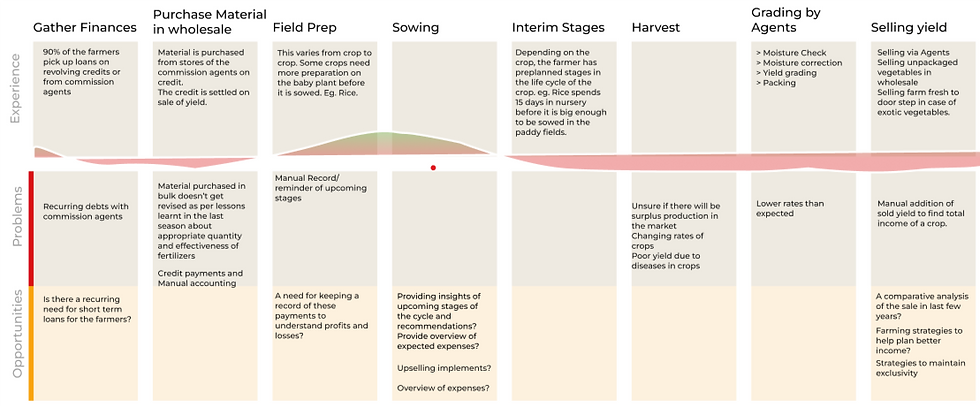

Typical Journey of a Farmer in India

Key Inference

-

The users depend heavily on manual record keeping of all expenses.

-

Ways of expense keeping is subjective and differs from farmer to farmer.

-

The records are mostly of how much is SPENT

-

There is no overview of total profit/ loss over a certain crop. Farmers “do not care” about the total income. They do not celebrate a profit since it is variable and heavily dependent on other things. They do not get bothered by losses because it is a part of their lifestyle and is “inevitable” but can change.

Conclusion

Primary concerns of the farmers include, recurring debts, weather conditions and lack of education. Manual expense management is not the pressing need. The mobile application to record expenses of the farmers would work as an opportunity for the organisation. It would help understand reasons and seasons in the year when a farmer takes credit or makes payments giving an overview of the cashflow. The success of the application highly depends on its alignment to the user’s mental model. The probability of adoption of the application would be high if its features cater to the challenges of the users, making it a part of their daily workflow.

Impact of the discovery

The strategy of the product was changed with the understanding, that it was an opportunity for the organization to promote short term loans, rather than being a solution to manual calculations as hypothetically assumed. It was important to uncover the users’ usage pattern and cash management through this application. It was launched as a concept with 25 customers for one season to understand their usage pattern. There was a continuous change in the features, based on moderated usability tests and insights drawn based on on field observations, to make the app more relevant to the customers.