Building a Service Design Framework for John Deere Financial (NBFC)

Overview

A global leader in agricultural and construction equipment, launched its Non-Banking Financial Company (NBFC) in India to provide tailored financial services to farmers and rural entrepreneurs. As part of scaling this offering, the organization recognized the need for a cohesive Service Design Framework to ensure consistent, user-centered, and efficient service delivery across touchpoints.

Role

Lead UX Researcher and Service Design Consultant

Challenge

The NBFC was growing rapidly, but the lack of a structured service design approach led to:

-

Fragmented customer experiences across digital and physical channels

-

Inconsistent service delivery across regions

-

Difficulties in aligning internal teams (field agents, credit officers, customer support, etc.)

-

Limited feedback loops from customers to improve services

The team needed a scalable, adaptable, and user-centered framework to:

-

Standardize service delivery

-

Improve customer experience

-

Drive internal alignment

-

Enable continuous improvement

Approach

1. Stakeholder Alignment & Discovery

We kicked off with immersion workshops across departments (product, field operations, IT, customer service, compliance, etc.) to:

-

Understand pain points in the current service delivery

-

Map internal goals with customer needs

-

Identify processes and platforms already in use

2. Customer Research & Journey Mapping

We conducted in-depth field research with farmers, dealers, and credit agents in rural India:

30+ contextual interviews

Shadowing of field visits and loan processing steps

Usability tests on digital platforms (loan apps, mobile support tools)

Output: End-to-end service journeys covering key phases – loan discovery, application, approval, disbursal, and repayment.

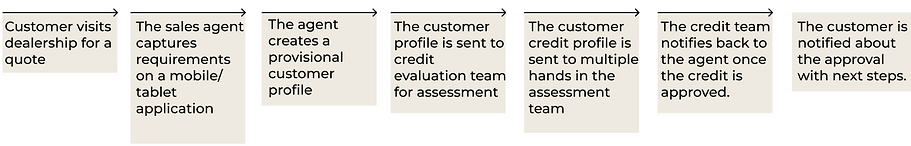

High level workflow

Part blueprint that shows the handoffs between different teams involved in credit assessment * (The complete blueprint is an intellectual property of the organization and cannot be shown publicly)*

3. Framework Design

I created a modular Service Design Framework with the following key components:

Service Blueprint Template: Standard model to visualize service operations including frontstage (customer interactions) and backstage (internal processes) ( based on nn/g ways to create a blueprint )

Persona Library: Segments based on behavioral insights, not just demographics

Touchpoint Inventory: Shared map of all digital, physical, and human touchpoints

Governance Model: Defined ownership, roles, and a playbook for service evolution

Feedback Mechanisms: Integrated loops from customer support, app reviews, field visits

Outcomes and Learnings

-

50-60% Error rate on field .

-

Redudant checks and human errors costing 5.5 man hours / day

-

Inconsistent, non standard and primitive practices of interaction causing clumsy experience and delay in process

-

Maximum errors were done upstream by the field agents who were using the new “improved ” application.

-

Reduced drop-offs in loan application via better digital-physical service orchestration

-

A reusable framework that scaled to new products like leasing and insurance

-

Service design needs to be contextualized for rural India – involving human interactions and tech limitations

-

Embedding service design in ops and tech conversations is critical for buy-in

-

Empowering local teams (not centralizing everything) makes frameworks sustainable

Recommendations and Opportunities

-

Most of the concerns originate at field level. Resolving errors at upstream will reduce errors at later stages.

-

Reassessing and limiting the responsibilities with Field agents to minimise error and trainings?

-

Effective training modules to educate and document tacit knowledge for better performance and hygiene checks at field level.

Final Service Design and implementation

-

The proposed service design was meant to realign the organisation with the needs of the users and their capabilities as field agents or credit evaluators.

-

The service design not just touched a key part of refining the digital touch points, and validating its need and importance but also introduced rigorous training programmes for the field agents to be successfully on boarded to the service plan.

-

The new proposal constructively criticised the skill matrix of each of the user involved which was not allowing a water tight arrangement.

-

The organization was educated and made aware of the misconception that more applications mean more success. This allowed them to also reduce screen usage and invest more in digital transformation than digitization.

Please note: The revised service blue print and journey maps are an intellectual property of the organisation and cannot be displayed.

The service proposal was then tested with users with a structured research plan/3 Interim, exhaustive tests at an interval of a quarter were planned and conducted to measure the success of the new proposal.